Subscribe to Our Newsletter

Successful brands always forge deep connections with their intended audiences. They usually accomplish this by learning what prospective customers need, then building a brand that addresses those needs. But as one brand initiative supporting a new product reveals, sometimes the right brand doesn’t connect by focusing on what customers need. It connects—powerfully—by focusing on what customers feel.

This branding-with-understanding story begins with OneMain Financial, which came to DeSantis Breindel with a century-long tradition of helping people with limited access to traditional lenders manage their financial lives. OneMain has done this by offering personal loans and insurance products to “non-prime” consumers, along with personalized support services.

Thanks to its long-standing presence in its market, OneMain’s leadership recognized that many of its customers didn’t have credit cards—a necessary component of true financial freedom and flexibility. So the company decided to launch a card of its own, along with digital tools to help its consumers manage their finances and a unique rewards program that incentivizes timely payments.

Our job was to explore and dimensionalize the experience of OneMain’s customers—ultimately revealing the deep emotional experiences and drivers that should inform the brand strategy for the new card.

Alone…and afraid

Our research showed that people without access to a credit card feel both isolated and fearful, worrying they lack the flexibility to quickly and conveniently meet their—and their families’—financial needs. It also showed that, despite these negative sentiments, they continue to hope for something better.

This insight underscored an important fact: OneMain’s new product brand should not focus on the card itself, conveying, “Now you can qualify for a credit card.” That message is widely used and could feel inauthentic to this audience, which has been let down by the financial system in the past. Instead, the brand needed to address customers’ underlying feelings of isolation and fear…and celebrate their aspirations for a better future.

So the new card’s brand was built around the idea of “Step Up Together,” emphasizing how signing up would enhance both consumers’ existing relationships with OneMain and their greater financial well-being.

This clear, strategic signal underscores OneMain’s commitment to helping people navigate their financial lives, preparing them to meet whatever challenges lie ahead. It also telegraphs a very powerful idea that directly allays customers’ biggest fear, sending the clear message: You’re not alone.

A better way forward

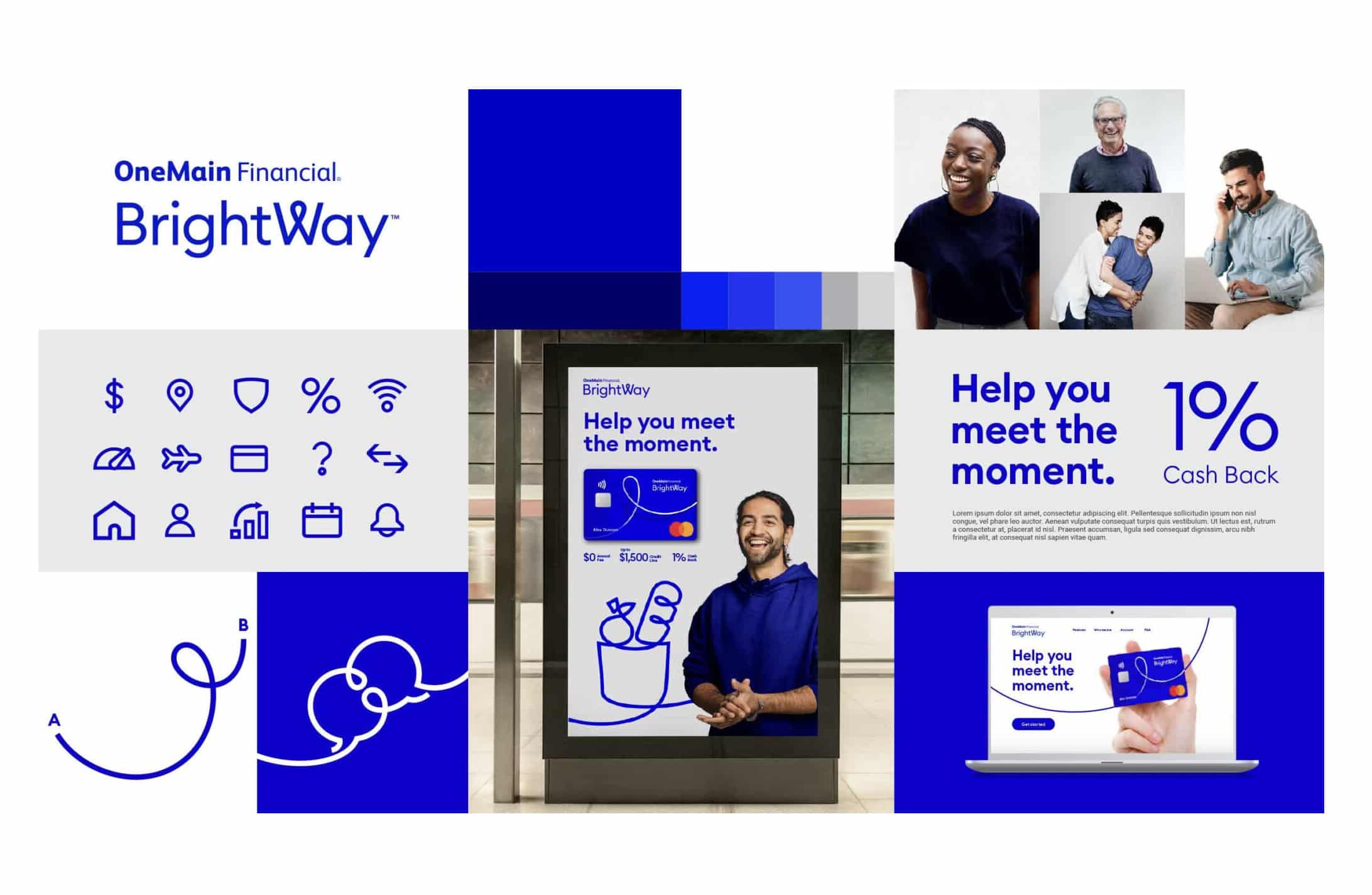

OneMain’s new card needed a name, so we tested several strong contenders to ensure the final choice would resonate with their consumers. The clear favorite was “BrightWay,” a name that suggested optimism and a positive path forward, connecting directly to customers’ deep-seated desire to improve their lives.

The card also needed a new visual identity—one developed as an extension of the parent company’s brand. In addition to maintaining essential visual consistency, this would also ensure the BrightWay card benefited from the goodwill of existing OneMain customers.

The new card’s visual brand features a distinctive loop, designed to drive home the idea that while financial ups and downs are inevitable, BrightWay card holders end up on top. Again, this brand facet was deliberately crafted to demonstrate that OneMain understands its customers’ anxiety about their financial position and wants to signal confidence that they can move toward a brighter future together.

This design, like the BrightWay card’s promise and messaging, is open and approachable—unlike the slick appearance of many high-end credit cards. This not only spoke to target consumers, who often strongly associate high-end lenders with rejection. It also gave the BrightWay card “digital shelf appeal.” When consumers use credit card comparison sites to choose their cards, the BrightWay brand immediately stands out as different.

The BrightWay identity system was rolled out in a mobile app, through a web experience and across a wide range of communication channels. Through messaging that emphasizes simplicity and support, and by making clear appeals to emotions—not only needs—BrightWay achieved immediate consumer acceptance post-launch.

To learn more about building a brand on pure customer understanding, contact us.