Investor Relations Officers (IROs) have always straddled the worlds of finance and communications. Interactive annual reports, for example, have been widely used to deliver critical messages to investors (and still are). But these tools, effective as they can be, are just that: tools. In today’s complex investment environment, where IROs face greater scrutiny from investors, regulators and the general public, they are seeking new ways to connect with their critical audience.

More and more, IROs are embracing strategic branding to tell a compelling value story—one that can captivate today’s discriminating investors. Depending on the nature of your business and its customers, it can make sense for you to connect with investors by aligning with (and perhaps extending) your corporate brand. In other cases, however, investors will merit a brand of their own—the company addressing their unique priorities clearly and directly.

Let’s explore the relevance of brand for IROs and how to answer that great question: to align or not to align?

Why branding matters in investor relations

In its simplest form, branding is the art and science of driving value creation by motivating actions among your business’s customers, prospects, investors, communities and employees.

Traditionally, IROs had little to do with branding; they let the company’s numbers do the talking, supporting them with presentations of management’s strategy. But as the world of investing has transformed and become more challenging, investors seek reasons to believe in a business’s greater value and longer-term growth paths. In this communications context, sharing a company’s performance and strategy within the framework of a bigger story has real power.

What does the company stand for? What is its core value proposition? What truly different experience does it offer? What reasons do investors have to believe that no matter how much the world or marketplace changes, your business will remain a success story?

Companies that answer these questions directly can connect more deeply with today’s investors.

B2C vs. B2B: Key differences in investor relations brand development

IROs who want to leverage brand to engage investors will need to make a fundamental choice: whether or not to align with the corporate brand. Considering the business’s relationship to its customers is a good place to start.

For businesses that market primarily to consumers, a corporate brand may not work. Its messages and priorities are too different, elevating benefits that are of less concern to investors.

Consider this example. One of our past clients was a major national refrigerated food company. Its brand is built on “freshness” and “nutrition”—great attributes for consumers, but less critical for investors.

Working with the company’s IRO and senior management, DeSantis Breindel developed an investor relations brand that told a compelling story about the company’s unique distribution network and the financial, marketing and logistics advantages it had created. These are the success and value stories that move this specific audience to action.

This new brand was deployed in an investor video and on the company’s investor website. It was included in the talking points of every presentation made by the company. Today, when management meets with investors, they have a clear perspective to share on what the company stands for, along with its long-term value proposition.

Consumers continue to see this company’s brands in the supermarket and think, “fresh.” But investors see the ticker symbol on their Bloomberg terminal and think, “scalable distribution platform.” Both perceptions and thoughts create value. So the business was correct to build two very different and largely unrelated brands for these very two different and largely unrelated audiences.

The situation is typically quite different for B2B companies. Often, the corporate brand and investor brand can drive value creation by being closely related.

For example, another of our clients leads a major network hardware company. The business’s customers—before making their multi-million dollar purchase decisions—demand financial strength, management depth and full transparency. These are also the precise qualities investors want to see when evaluating an investment in the company.

In this scenario, the corporate brand works perfectly for investors and customers. It must be carefully adapted to align effectively with investor concerns, but it need not be a separate brand.

When investor communications DO align with the corporate brand

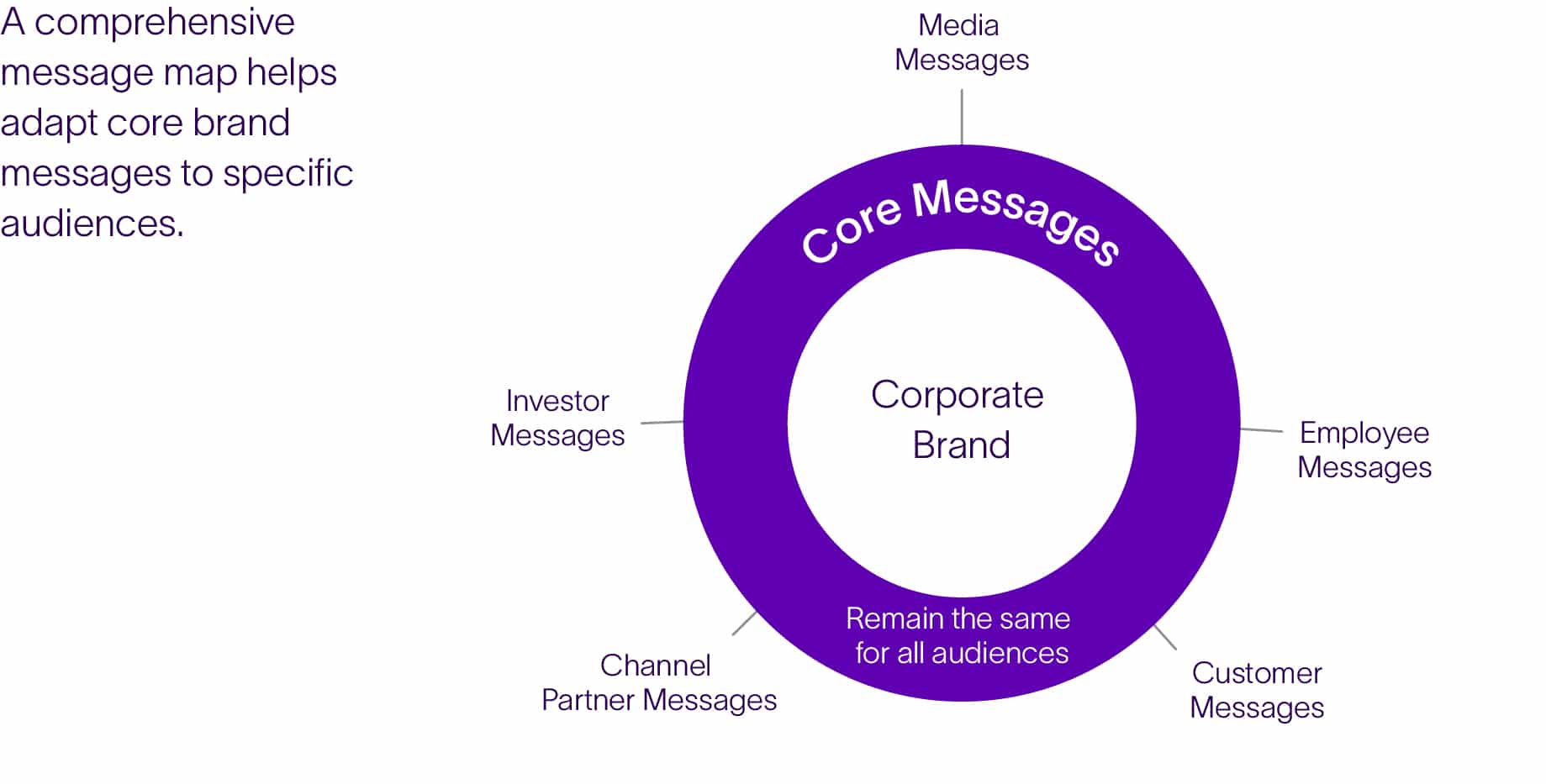

Message mapping is a highly effective tool for aligning communications strategically—and extremely useful when an IRO chooses to align an investor relations brand and corporate brand. As B2B brand-builders, we always use these maps to ensure messages will meet the distinct need of each audience.

Starting with the company’s brand, we develop a set of core messages that remain unchanged. These are the types of messages you’d typically see on a company’s homepage, the hub where all audiences meet—customers, prospects, the media and investors.

Next, we “map” individual messages to individual audiences, always careful to ensure that they’re grounded in the brand itself (see diagram).

Subscribe to Our Newsletter

In the case of our network equipment client, a key brand pillar is “transparency.” For customers, transparency means windows into the company’s R&D process so they can see that their networks will evolve along with technology. For investors, transparency means a commitment to timely financial disclosures and explanations of how financial results are derived and interpreted. The notion of transparency stems from the same core brand promise. But it is “mapped” in two very different messages to two very different audiences.

Another example of a B2B company that successfully adapted its corporate brand to appeal to investors is a long-standing software client. This company’s customer-focused brand was built on speed and efficiency. Its software enables R&D operations to perform more experiments faster and at lower cost, fulfilling its clients’ need to fill discovery pipelines without extensive CapEx investment.

The company’s investor relations brand used the corporate brand as a foundation but essentially turned it upside down. Investors needed to understand that there was a huge and growing market for the company’s solutions, so the brand (and supporting messaging) addressed the company’s products secondarily. The brand focused primarily on the company’s ability to meet emerging needs in the marketplace—elevating the part of its story that investors care about most.

When investor communications DON’T align with the corporate brand

If the corporate brand can’t be leveraged for investor communications (as is often the case with many B2C companies), it makes sense to create a separate investor relations brand.

The process is similar to that of building a corporate or product brand—and is far too complex to cover comprehensively here. But in short, it always begins with research to understand audiences’ perceptions and needs. This leads to the development of overarching positioning that succinctly encompasses the company’s value proposition to investors, as well as supporting messages.

Often, a new brand’s positioning and messages are tested on a small group of investors to ensure that they resonate appropriately. Once an investor relations brand is in place, the tools for deploying it are similar to those used in corporate or product branding: traditional and digital advertising, content marketing, trade shows and public relations.

Whether you choose to align with the corporate brand or not (based on your business and audiences), the business will benefit. Companies with an investor relations brand gain the advantage of communicating with a focused, consistent message that will resonate deeply with this distinct audience. Your annual reports, presentations, investor relations website and even casual interactions between management and asset managers will all feature the same greater story about the value of your business and where it’s headed.

The result will be value creation in the form of engaged investors who both review your numbers and understand your greater story—a story full of reasons to believe.

To explore strategies for creating value with an investor relations brand, contact us.

Originally published September 10, 2021.